As a rule, Inflation impacts all financial assets,- from stocks, treasury bonds, and corporate bonds to cash, commodities, and real estate.

At the same time, the extent of the inflationary impact on different companies can vary depending on how exposed these companies are to the adverse effects of inflation.

The factors that help to determine the level of a company’s vulnerability to inflation damages are its market share, pricing power, cost components, and structure as well as how much investment the company would require.

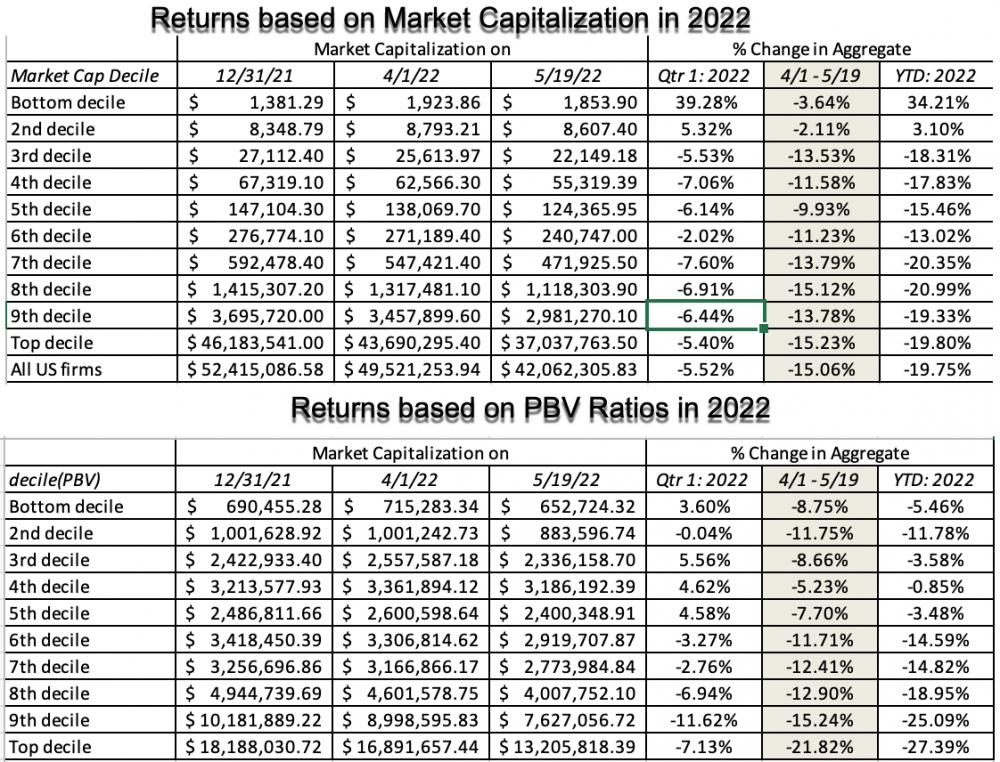

This year has turned out quite painful for investors: by May 19 YTD 2022 collective market capitalization of all US firms dropped by 19.75%, with the bulk of the drop (-15.06%) occurring after April 1, 2022, and during the period (April 1- May 19, 2022) when inflation has been the prevailing sentiment among investors. The three worst performing sectors were technology, consumer discretionary, and communication services, and the best performing sectors were energy and utilities.

Professor of Finance at the Stern School of Business at NYU Aswath Damodaran suggests that companies that have more pricing power on the market, low input costs, and operate in a business where investments are short term and can be recovered, are more secure from inflation risks. Also, companies that have a large and stable earnings stream and a light debt load are less prone to inflation-induced failures.

According to the expert analysis, small-cap stocks have outperformed large caps in 2022, and the companies with the lowest price to book stocks have done less badly than high price to book stocks. Portfolios that are over weighted in risky, money-losing companies have been hurt more than portfolios that are more weighted towards companies with less debt and more positive cash flows.

In addition, the riskier firms have been more affected by inflation, although the professor marks one exception to this rule: stocks with the lowest betas have also performed badly in 2022. On bond ratings, there is no discernible link between ratings and returns except for the lowest-rated bonds (CCC and below).

To find out more about inflation effects on company values, read an article: https://aswathdamodaran.blogspot.com/2022/05/a-follow-up-on-inflation-disparate.html?