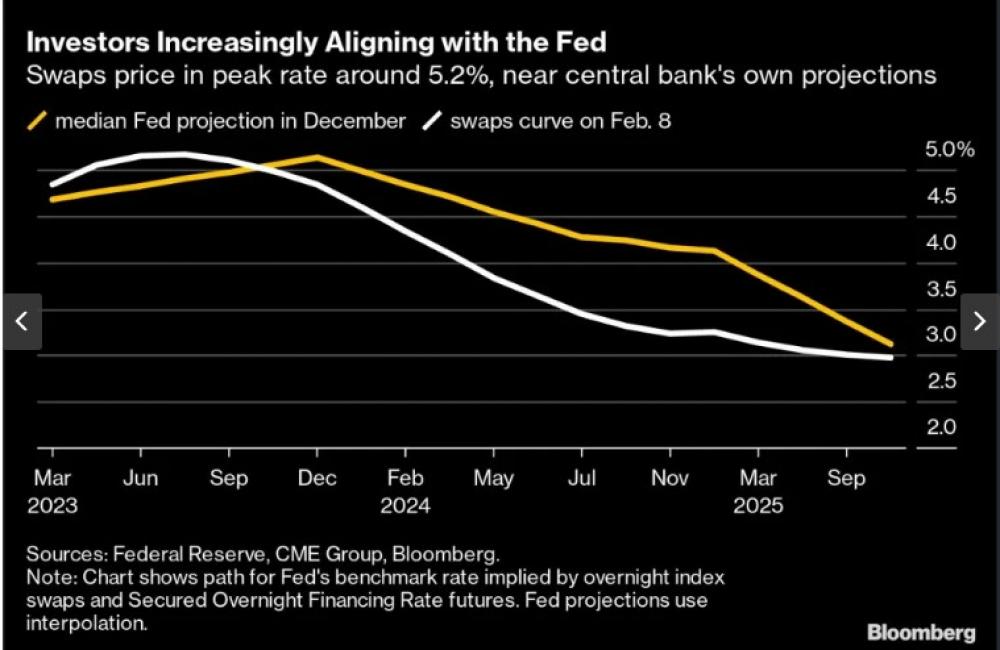

In the last week, Wall Street has seen profuse trading in options on the Secured Overnight Financing Rate, which is tightly connected to the Fed’s federal funds rate – as traders dialed down bets on rate cuts in the second half of 2023. The peak level of the rate hike factored into the US swaps curve for the Fed’s benchmark rate by midyear is now 5.2%, up from 4.91% on February 02. This level corresponds with the median view of the Fed’s officials' projections published in December 2022.

On February 07, after Chair Jerome Powell suggested the latest monthly employment data may impel more tightening than previously anticipated, traders built up large positions in options that, according to Bloomberg, would make $135 million if the central bank keeps tightening until September.

Preliminary open-interest data from the Chicago Mercantile Exchange confirmed the $18 million wager placed Tuesday in Secured Overnight Financing Rate options set to expire in September, targeting a 6% benchmark rate. That is almost a percentage point more than the 5.1% level for that month currently priced into interest-rate swaps. According to Bloomberg calculations, the trade would break even at a policy rate of around 5.6% and make $60 million should the Fed raise it to 5.8%.

More buying of the same types of options continued the following day alongside similar bets expressed in different ways.

While the Wall Street base case scenario draws on two rate cuts in the latter half of 2023, traders' sentiment now appears to shift to just one.

Stronger- than- expected US job market report released last week also stepped up traders’ bets that the Fed would raise interest rates two more times. The prospect of more interest rate hikes later in the year prompted yields on the 10-year Treasury to climb by nearly 12 basis points to 3.651% — its highest since January 11. The 2-year Treasury yield was trading at 4.485% after going up more than 18 basis points.