Once Intended as a tool for earning interest, bonds have grown into a complex, $100 trillion global market offering investors a wide range of solutions with steady and lucrative returns. Before we go deeper into the diversity and complexity of the global bonds market, we will take a moment to define what constitutes Essentials of the Bond Market, and how can the bond be useful for the investor to achieve his investment plans.

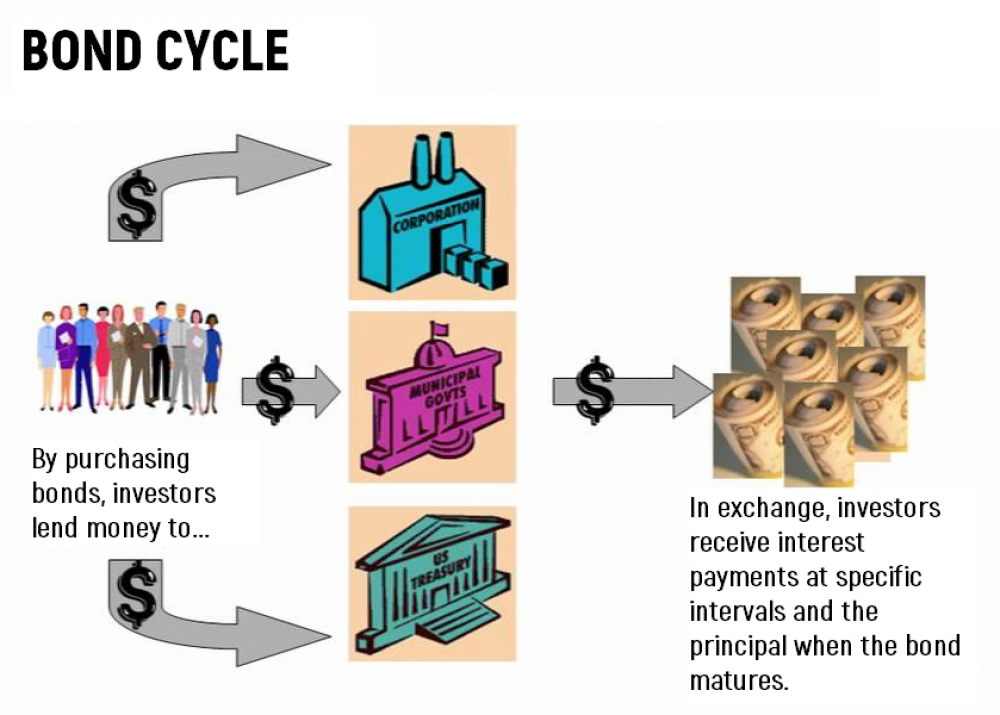

Along with stocks, real estate, currencies, and other assets, bonds are a quite common, and practical tool to include in an investor’s portfolio. A bond is a security that constitutes a debt of the bond issuer or the borrower to the bondholder or the lender. Many entities can issue bonds when they need financing, - corporations, governments, municipalities, and other entities. Bonds are often referred to as “debt securities”, “debt obligations”, “notes” or “bills”. Interest on a bond is called a coupon and it is paid regularly, typically per annum. The bond principal or face value is redeemed at a specified time, which is called maturity.

To determine the coupon payments, the debt issuer assesses the interest rates prevalent on the market for similar bond types. For example, it can be a five-year bond with a 5% annually paid coupon. The duration of time specified for the bond to reach its maturity affects the investor’s decision to purchase a bond, as it must meet the investor’s expectations of potential return for the incurred risk.

A longer-maturity bond always bears an additional risk, which is reflected in the higher interest rate, or a coupon the bond issuer promises to pay. Thus, an investor would usually earn bigger returns on longer-term bonds in exchange for greater risk. There is also some risk of non-payment or default on bonds, and, independent credit rating services, such as S&P and Moody’s, assess that risk, and publish credit ratings. These ratings help investors make better investment decisions. In our next posting, we will tell you more about what factors determine the bond's value.

Bear with us, and you will learn many interesting and practical concepts about capital markets