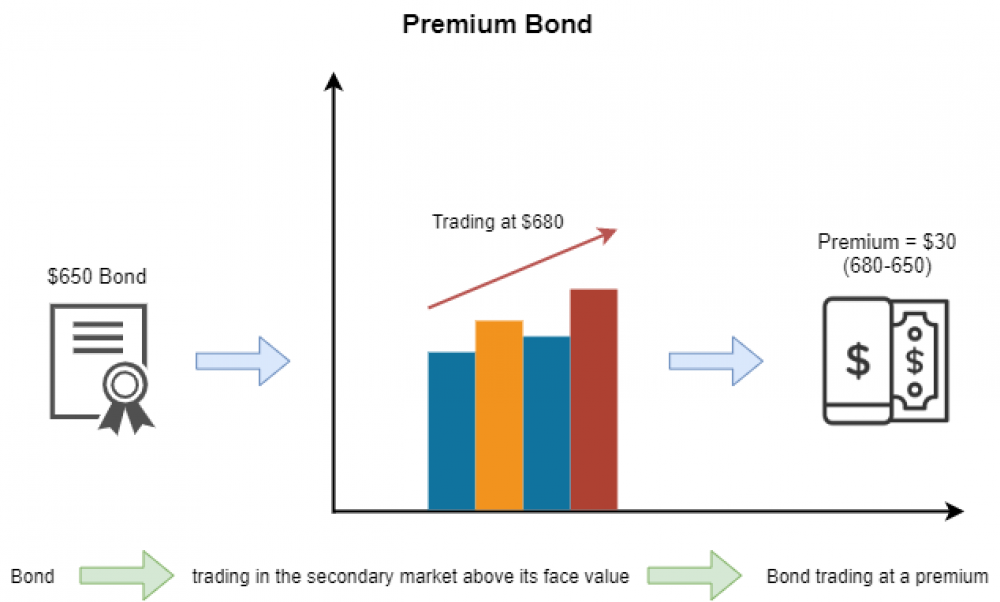

A premium bond is a security that trades in the secondary market at a price higher than its face value. This occurs when a bond’s coupon rate exceeds its prevailing market interest rate. For instance, a bond with a face value (par value) of $650, trading at $680, indicates that the bond is trading at a premium of $30 ($680-650).

When new bonds with lower interest rates appear on the market, the older bonds of the same type with higher interest rates attract investors more, and consequently, such bonds start trading at a premium. Investors who buy such premium bonds pay a higher price hoping eventually to get a higher return than they would get on other investment alternatives, which could easily happen especially if the interest rates keep rising.

Since many bond investors are moderate to low-risk takers, the credit rating of a bond is an important indicator. When the credit ratings of a bond and the issuing company are high, this will usually attract investors to buy such bonds and pay a premium for a bond with a high rating from a financially viable issuer. Premium bonds can be a good investment for those seeking low-risk investments, as they provide stable, more lucrative returns than lower interest-paying bonds.

Some bonds have floating coupon rates that change with every period. Some investors use changing coupon rates to their advantage and make higher gains by selling such bonds on the market at a premium. Sometimes it happens that the premium price paid by investors for the bond ends up being significantly higher than the returns it yields., turning them into overvalued debt instruments.

Stay tuned with Wolfline Capital, and in our next post on capital markets, we will explain how to calculate the price of a premium bond trading in the open market.