The sequence of events that has rolled on the financial markets over the last week points to one of the highest degrees of volatility ever observed.

The S&P 500 and the Dow started gaining some foothold on May 11, after CPI report data indicated the U.S. inflation slowed on a year-on-year basis last month, encouraging investors with some hope that price surges have reached their highest peak. The annual consumer price growth subsided to 8.3% in April from 8.5% in March, although it was above the 8.1% estimate.

The Dow Jones rose 0.66%, to 32,373.99, the S&P 500 gained 0.45%, and the Nasdaq Composite dropped 0.52%.

Uncertainty about the Fed's next moves, - and about whether these moves will tame the inflation without causing a recession — has stirred up heightened volatility across the financial markets, bringing the S&P 500 down by nearly 17% from its recent record high on Jan. 3, 2022, and Dow Jones by nearly 27%.

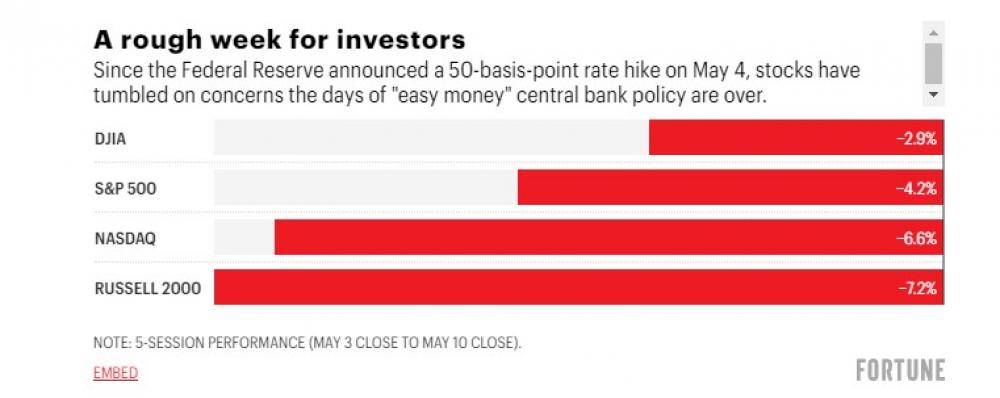

Wall Street has been suffering through a long stretch of declines that has pushed the S&P 500 toward a bear market territory. On May 04, 2022, The Federal Reserve raised interest rates by 0.5%, marking the biggest increase since 2000 and the second this year. Following the Fed’s announcement, the S&P went up by 3%, marking the stock market's best performance since May 18, 2020. The Nasdaq grew by 3.2%, which was its best day since February 24, 2022, and the Dow closed 932 higher, rising 2.8%, indicating the index's best day since November 9, 2020.

However, in a matter of just about 24 hours stocks slid in a violent U-turn from the prior session giving back all gains after a rally on Wall Street a day earlier, as traders continued to ponder over the Federal Reserve's latest monetary policy decision. The S&P 500 shed 3.7%, DJIA dropped 1,120 points or 3.3%, and the Nasdaq Composite tumbled 5.2% Experts point out that such a vehement turnaround in financial markets is attributed to a great deal of uncertainty about how to digest a stunning policy change by the Federal Reserve.

Markets have become so used to the Fed’s expansive monetary policy over the past two decades that investors are confused and do not know how to react now that the central bank is scaling back on QE and raising the interest rates so aggressively. “This is a very big change, and the markets are having trouble processing it,” Robert Dent, senior U.S. economist for Nomura Securities wrote for New York Times.

"Thursday's stock selloff suggests that Wednesday's post-FOMC market action was a relief rally. We are still not out of the woods yet, as there is still too much uncertainty over how the Federal Reserve's actions will tame inflation without causing a recession," Zach Stein, Chief Investment Officer of Carbon Collective, wrote in an email to Yahoo Finance.