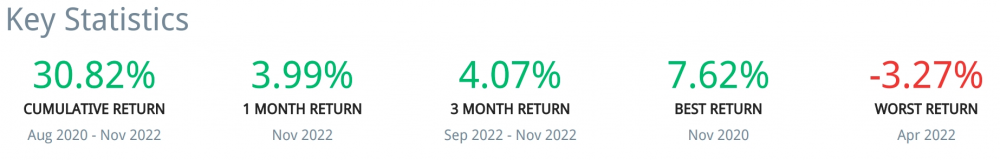

The New Year is just around the corner. While the US stock market indices have kept swinging through the bear market territory in November, our partnering company in asset management Sigma Global Management has managed to generate a positive return of nearly +4% on its Long-Short Volatility-based Strategy

What makes Sigma's result even more impressive is that the company has maintained a positive YTD return in the face of persisting double-digit drawdowns in US stock market indices. Moreover, the company expects that December will also please them with good results on the utilized investment strategy.

Why? The detailed answer is included in the report, and in short: Sigma's analysis of market volatility, as well as the forecast for the Pre-New Year months, turned out to be correct, which adds more credit to the US equity long/short volatility-based strategy applied by the company.

This report can be called a Pre-New Year kind, as the next time Sigma will have the pleasure of connecting and sharing its news with its clients will be in January 2023. As such, in the November report, Sigma paid particular attention to the global forecast for the year 2023, and finally tried to answer the question - will there be a recession? Spoiler: the company expects it, but not everything is gloom and doom.

And as usual, you are welcome to learn about Sigma Global Management's work in November, its vision for the near future, and the performance data of the company's Long-Short volatility-based strategy since its launch from the link to the report below.

https://sigmaglobalmanagement.com/assets/sgm_nov2022_report.pdf