As the era of next to zero interest rates is coming to an end, and growing inflation persists across the world, bonds prices start declining. Today we would like to review a bond strategy that can help investors with their bonds portfolio diversification in these times of market uncertainty.

With rising interest rates looming on the horizon, investors in fixed-income assets seek to adapt their strategies to mitigate interest rates risks of their fixed-income securities portfolios.

Both inflation and rising interest rates can have a drastic impact on investors’ fixed-income portfolios. Typically, bonds that have the longest maturity dates and the lowest coupons are the most vulnerable to interest rate rises. To protect themselves from rising interest rates investors may sell some long-duration bonds and invest the funds into short-duration bonds instead.

Typically, a short duration bond is usually a bond with a maturity period of up to 5 years. Short-term bonds are considered less risky because the principal is redeemed sooner, and it can be reinvested faster.

A bond ladder strategy is one of the most feasible ones in such situations as it involves building a portfolio in which bonds or other fixed-income securities mature continuously at evenly spaced periods. When one set of bonds matures and gets repaid, the funds are rolled over to another set of securities with similar duration and, the same or higher-yielding interest rates.

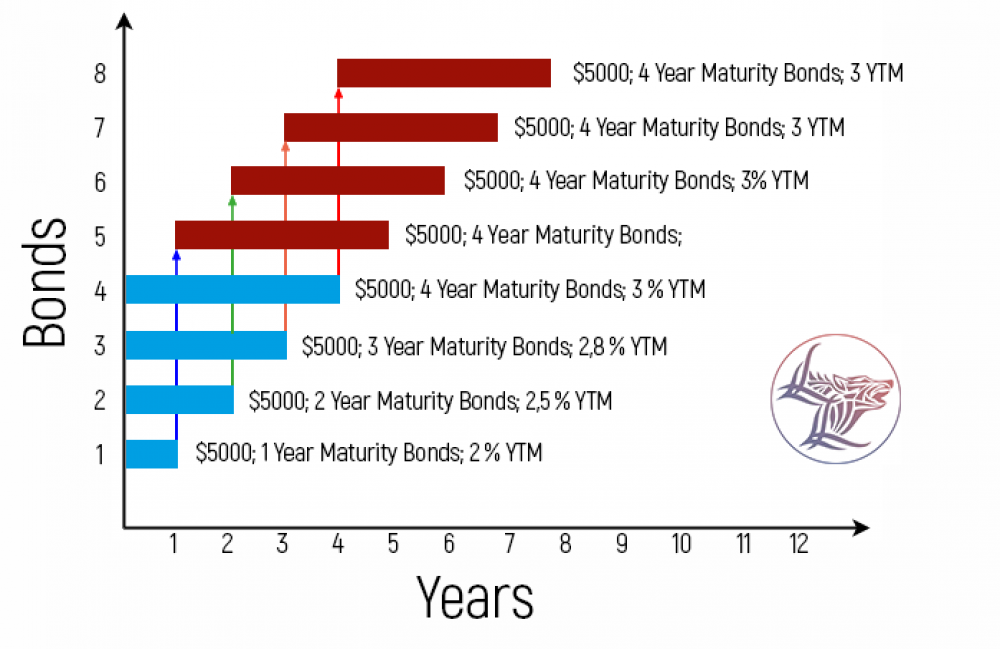

For example, let us assume an investor has $20,000 to invest and wants the maturities to be spread within one year over 4 years. The investor then would purchase $5000 worth of fixed income securities each year over 4 years.

Upon the maturity of the 1-year bonds, the investor would reinvest the proceeds into bonds with a 4-year maturity at. Then, upon the maturity of the two-year bonds, they would be rolled over into the next set of bonds with a 4-year maturity. This will keep the investor’s ladder position and this process can be repeated each year until the investor’s portfolio of all 4-year maturity bonds expires and no more reinvestment is made. The attached graphic provides a clear visualization of the described process.

This strategy is deemed to generate higher average yields while lowering interest rate risk as well as liquidity.

Stay tuned with Wolfline Capital and you will learn more insightful and useful things about capital markets and asset management.