Russia faced possible default on its foreign debt for the first time since 1998 as time was running out on overdue interest payments blocked by western sanctions.

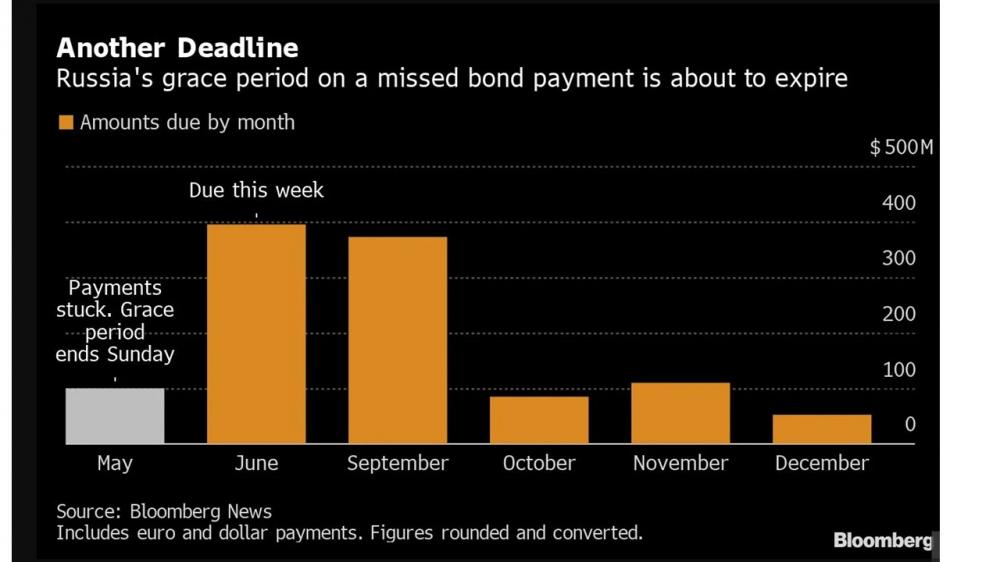

About $100mn worth of interest on Russian sovereign debt is due to foreign bondholders by June 26, the end of a 30-day grace period during which the country must make the payments to avoid defaulting. The Russian government has the money to pay but the mounting Western sanctions have cut off the avenues for transferring payments in dollars.

At the beginning of June, the European Union imposed sanctions on Russia's National Settlement Depositary, which health with processing the bond payments. This further hampered Russia's means of making payments abroad. Also, on June 24, a $159 million payment comes due on a note maturing in 2028 with no alternative options to the dollar. The chances of it going through are slim since the US Treasury waiver allowing Americans to receive Russia’s sovereign payments expired on May 25.

Russia said it was being forced into default and is trying to find ways around sanctions to make payments. Russia's President Vladimir Putin signed a decree setting out a mechanism for servicing bond payments in rubles, however, the presumption of these bonds does not hold provisions for making payments in rubles. Earlier, Finance Minister Anton Siluanov had said the government would transfer rubles that could be converted into foreign currencies and that foreign Eurobond holders would need to open ruble and hard currency accounts with Russian banks to receive payments.

According to Bloomberg, a panel of 13 banks and asset managers have asked the US Treasury to allow trading in Russian assets temporarily, so that investors who wagered on Moscow defaulting can be paid what they’re owed.

The Credit Derivatives Determinations Committee, which regulates the credit derivative swap market, was engaging with the US Treasury’s Office of Foreign Assets Control on the matter, according to people familiar with the matter. OFAC hasn’t made a decision, and one was not likely to come until after the Group-of-Seven summit this weekend, a person familiar with the matter said.