As we have pointed out before, the number of SPACs has more than doubled in 2020 compared to 2019 records, and up through the second quarter of 2021, the total number of SPACs reached 386 raising over $100 billion.

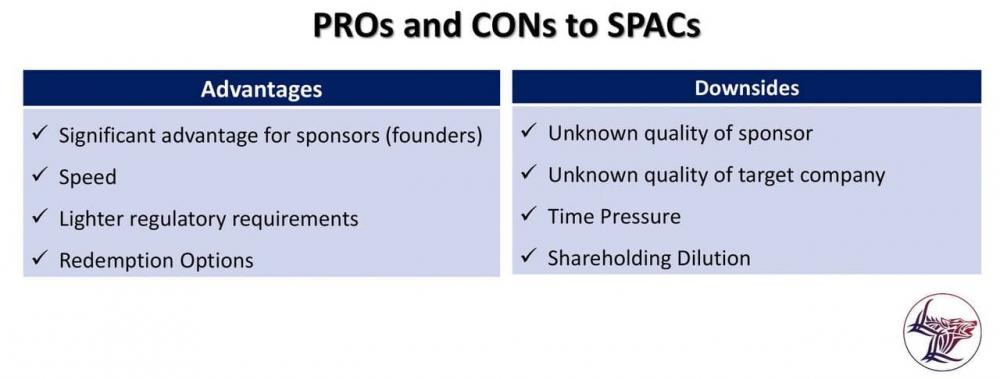

Despite the increasing popularity of this financial vehicle, there are several pros and cons for involved parties, that we will examine below.

Some of the advantages to SPACs include:

• Significant advantage for sponsors (founders): The sponsors, or the founders of SPAC who take it to an IPO, have a chance to make significant profits regardless of the acquired company’s performance after the IPO.

• Speed: SPAC only takes 3-5 months, whereas as an IPO may take up to several years from the beginning to an end including all the preparations and the typical IPO process can take 2-3 years from start to finish, while a SPAC only takes 3-4 months. For private companies looking to go public quickly, a SPAC is an attractive option.

• Lighter regulatory requirements: SPACs founders have fewer regulatory hurdles to overcome than traditional IPO issuers. Companies can negotiate the terms of their public offering with shareholders and employees.

• Redemption Options: Initial shareholders can redeem their shares if the sponsor cannot find a target company in two years after an IPO or if the acquisition falls through.

There are some downsides to SPACs that should also be listed:

• Unknown quality of a sponsor: Investors are more reliant on the sponsors’ power to convince them to invest than on the performance of the business for making investment decisions, which adds a certain level of risk.

• Unknown quality of a target company: Since there is less regulatory scrutiny involved, the quality of a target company can be questionable, which can pose a certain risk for investors.

• Time Pressure: Sponsors usually have only two years to identify a prospective viable company for an acquisition. If this is not done within this time, the SPAC is liquidated.

• Shareholding Dilution: When sponsors exercise warrants for purchasing additional common shares at an exercise price of $11.50, it causes dilution of common shares’ value.

Eventually, most large companies tend to go for conventional IPO processes because they have sufficient capital, and they can afford to sell shares and make a profit. SPACs are quite popular among startups and small companies as they offer a short path to acquiring a higher valuation.