As we already know, when an investor purchases a bond, he expects to get a return on his investment. However, the value of the bond on the open market may easily fluctuate depending on the prevailing interest rates changes. When interest rates change, bond prices adjust accordingly, so that their YTM (Yield to Maturity) corresponds to the YTM of the new bond issues.

When the prevailing interest rates decrease below the coupon rate, bond prices exceed the face value. This happens because such bond offers higher interest rates compared to the older bonds of the same type already circulating on the market. Consequently, the newer bond’s value increases, and its price rises above face value reflecting the discrepancy between the higher coupon rates and the current market interest rates.

The same pattern only in the reverse applies when the current interest rates exceed the coupon rate. When the interest rates rise above the coupon rate the value of the bond decreases because the current market interest rates can offer investors a higher return, than this bond. This means the bond trades at a discount. This is where the name “a discount bond” derives from. A discount bond is sold at a price lower than the bond’s face value, adjusting for the discrepancy between the rise of the prevailing interest rates and the coupon rates.

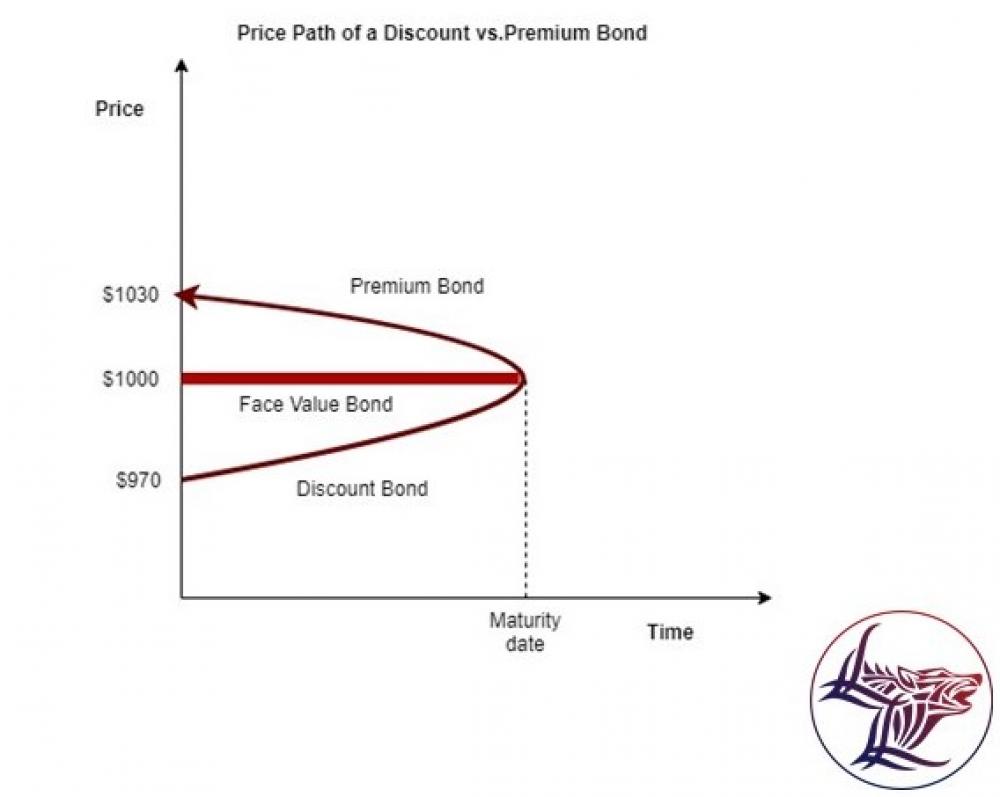

By way of example, let us take a bond with a face value of $1,000 and a coupon rate of 3% that amounts to a $30 annual interest payment. If the prevailing market rates drop to 2%, the bond value will go up, and the bond will trade at a premium of $1,030. If the current interest rates go up to 4%, the bond value will decrease, and it will trade at a discount of $970.

Buying a bond at a discount does not necessarily mean it provides better returns than other bonds. Sometimes, discount bonds may come with a higher risk of default, and this depends on the financial standing of the issue. A bond rating agency can lower the rating of the issuer if there is a likelihood that the issuer may default on its obligations.

On the other hand, discount bonds can appreciate over time if the bond issuer does not default. The face value of the discount bond will still be redeemed to investors if the bond is held to maturity, even though the investors purchased the bond at the price below the bond’s par value.

Bear with Wolfline Capital, and in our next posts, we will tell you more about bonds' coupons and their correlation with YTM.