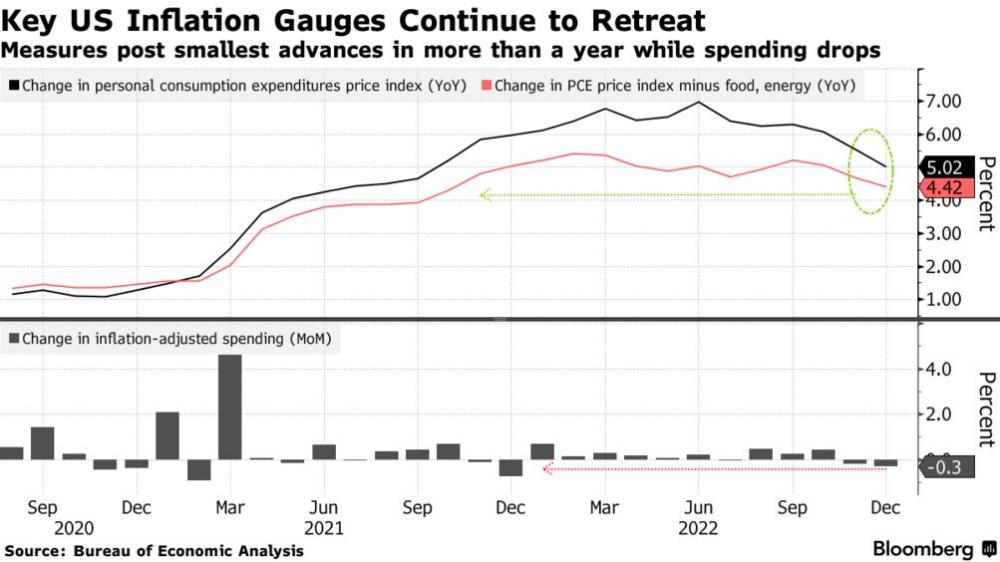

The Fed’s tightening measures are showing effect, as the Commerce Department data released on January 27, 2023, indicated that Fed's preferred inflation gauge, the personal consumption expenditures (PCE) price index continues to retreat. In December 2022 it posted a 5.0 % year-on-year increase, which is 0.5 percent points down from 5.5 percent in November.

Stripping out the volatile food and energy components, the PCE price index was up 4.4 percent from December 2021. The central bank focuses on the PCE price index as it reflects actual consumer spending, including shifts to less expensive items, unlike the more well-known consumer price index.

Spending by U.S. households decreased 0.2% in December from the prior month, the Commerce Department said Friday, compared with a downwardly revised 0.1% decrease in November.

The PCE data may escalate concerns that the economy’s primary driver, the American consumer’s spending power is starting to crack under the weight of higher prices and interest rates.

Investors hope that the economic slowdown will force the Fed to slow rate hikes further at the next policy meeting on January 31 and February 1.

"Hammered by higher prices and borrowing costs, and feeling less wealthy, U.S. households are cutting back, and will likely contribute to a contraction in GDP in the first quarter," said Sal Guatieri, a senior economist at BMO Capital Markets in Toronto. "The good news is that they are also pushing back against price hikes, which will help the Fed tackle inflation and limit further rate hikes."

The Fed’s Chair Jerome Powell has emphasized that the central bank plans to keep boosting its key rate and to keep it elevated, potentially until the end of the year. Yet that policy may become unfeasible if a sharp recession takes hold. Markets expect the final rate to rise to 4.9% in June, still below many Fed officials’ expectations of beyond 5%.

"That in-line data is certainly going to be sufficient to justify the Fed slowing down to a 25-basis-point rate hike when they make their decision on February 1," Art Hogan, Chief market strategist at B Riley Wealth said to Reuters.