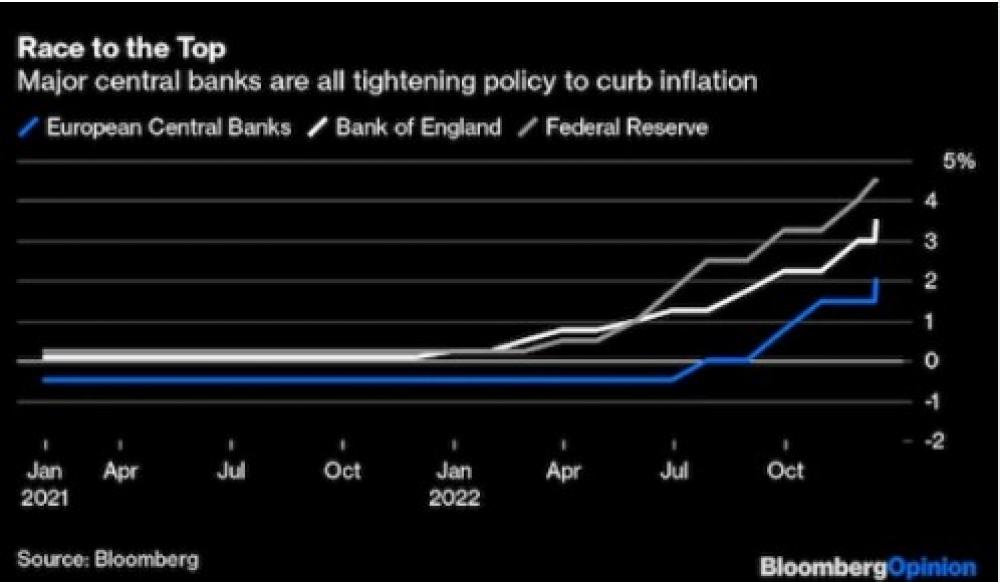

A more dovish message by the Fed of adopting a new slower pace of rate hikes echoed in BoE and ECB 0.5 percentage point rate hikes this week, putting strong selling pressure on government bond markets.

BoE has hiked the bank Rate by 0.5 percentage points to 3.5%, and the European Central Bank (ECB) has raised its main borrowing cost by 0.5 percentage points – to 2.5% – in an attempt to lower inflation across the Eurozone. Germany's announcement that it would issue a record amount of debt in 2023 to fund an energy support package is also believed to have added fuel to upward pressure on yields.

As prices tumbled, the yields on interest rate-sensitive two-year German bonds surged 24 bps, their biggest one-day jump since 2008. Italian borrowing costs were last up almost 30 bps at 4.13%, while European shares slid nearly 3% and stocks on Wall Street tumbled 2%.

The yield on Germany's 10-year government bond ticked up 1 basis point (bp) to 1.937% in early trading. Italy's 10-year yield was up 3 bps to 3.887%. That pushed the gap between Germany and Italy's 10-year yields 2 bps wider to 194 bps.

European Central Bank President Christine Lagarde stated to Reuters there will be more 50-basis-point rate increases for a period of time and that the ECB was not “pivoting” yet. “The reaction in European bond markets has been brutal,” said Antoine Lesne, head of EMEA strategy and research for State Street’s SPDRETF business.

Interest rates also went up in Switzerland, Denmark, Norway, Mexico, and Taiwan on Thursday, following a U.S. rate hike a day before.