As we have discussed earlier, when a company decides to have an IPO, it must select a reputable underwriter that is typically an investment bank that will follow through the steps of an IPO with the issuer such as determining the issue price, publicizing the IPO, and assigning shares to investors.

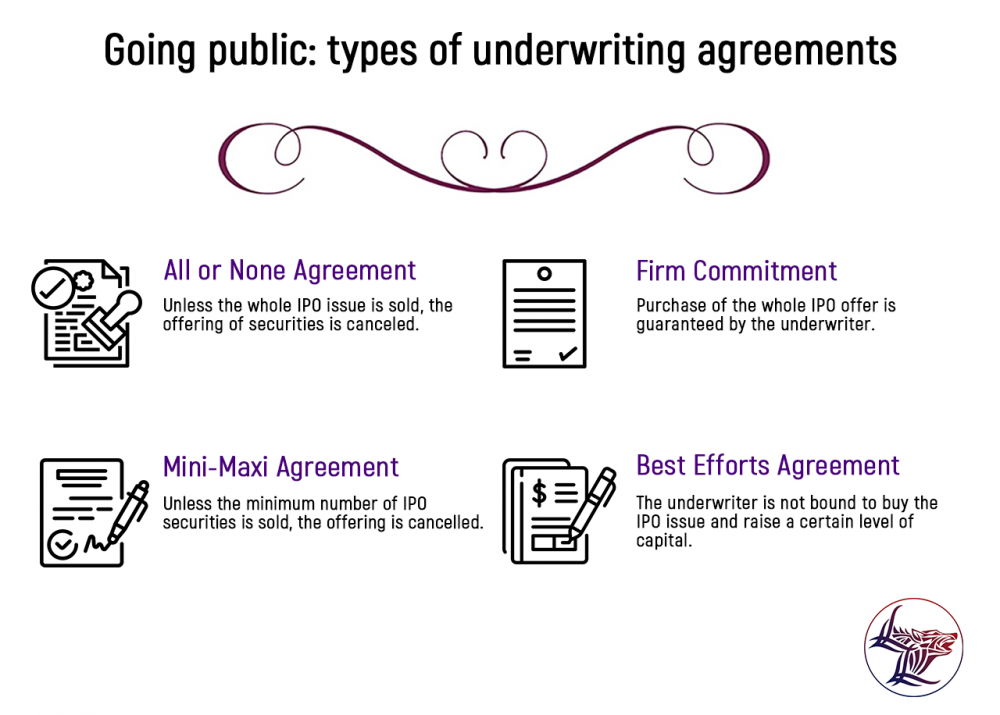

After choosing an IPO underwriter, the IPO issuer and the underwriter must formally agree to specific IPO terms by signing an underwriting agreement. Typically, there are four main several types of underwriting agreements that an IPO issuer can enter in with the underwriter:

• All or None Agreement: With an all or none underwriting agreement, the issuer sets forth the condition that he receives the proceeds from the sale of all the securities. Unless the whole IPO issue of securities is sold, the offering of securities is canceled, and the investors’ funds are returned to them. Investors’ funds are held in escrow until the sales of all of the securities have been completed.

• Mini-Maxi Agreement: This agreement is similar to the All or None Agreement. If the minimum number of securities under the IPO offering cannot be sold, the offering is called off and the investors’ funds are returned to them.

• Firm Commitment: Under such an agreement, the underwriter agrees to purchase the whole IPO offer and resell the shares to investors, thus guaranteeing to the issuing company that a certain sum of money will be raised regardless of whether the underwriter can sell all the securities to investors.

• Best Efforts Agreement: The underwriter does its best to sell the securities offered by the issuer but is not obligated to buy them and only sells the securities on behalf of the issuer. Such type of an agreement does not bind the underwriter with a guarantee to raise a certain level of capital for the issuing company.

The choice of the suitable underwriting agreement to settle on depends on a variety of factors. If there is substantial demand for the offering, then the chances for a firm commitment basis agreement are higher. Obviously, a firm-commitment agreement is the most favorable one for the IPO issuer, as it warrants all of the issuer's money right away. In this case, if not all the securities are sold, the risk is entirely on the underwriter.

As such, underwriters often try to protect themselves by adding a market out clause in the underwriting agreement. This clause exempts an underwriter's obligation to purchase all of the securities from the IPO issuer in case if circumstances beyond the underwriter's control impair the quality of the IPO offering. For example, if the issuer is a biotech company, and the FDA denies the approval of the company's new drug.

Stay tuned with Wolfline Capital, and you will learn more substantive and useful information on capital markets and asset management.