In our previous article on VAR, we talked about how we can identify relatively stable equity through a smaller dispersion of the stock closing price within VAR limits and the lower quantity and VAR tail quantiles. Today we will examine how investors can implement a long-short approach in building long-short pairs of stock, factoring in the VAR confidence level.

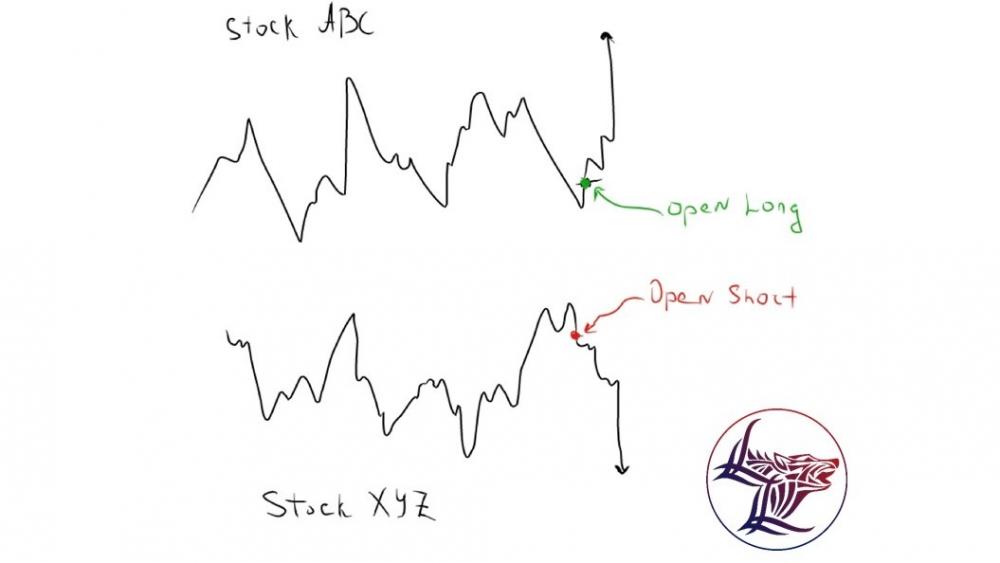

Let us first define what is a Long-Short approach? The Long-Short approach usually means that an investor would sell the overvalued stock position and would buy the undervalued one. Now we will examine how VAR can help us identify overvalued and undervalued stocks.

The stability of VAR points to the stock’s propensity to return to its mean value. The actual value of VAR and VAR tail quantiles that we gathered from the analysis of the VAR critical range in our former post, purportedly indicates the frequency and magnitude of VAR tail quantiles breaking through the VAR’s limits.

The Long-Short Approach based on VAR must include two important prerequisites:

- Both securities must have a stable VAR at the same time. As we covered in our previous post on volatility, the stability is expressed in confidence level to VAR estimate that shows the correspondence of the forecast VAR ranges to its real values over time;

- Both securities must simultaneously diverge in the opposite direction seeking to return to their mean value. One of the securities is positioned in the upper boundary of the VAR tag quantile, and the other is positioned in the lower boundary of the VAR tag quantile.

Consequently, to select a long-short stock pair, we need to find two equities seeking to return to their mean value; sell the stock that has been gaining considerable value over a long period; buy the stock that has been losing significant value for too long.

These are the fundamentals of forming long-short positions for two stocks based on VAR. However, other important parameters have to be included in the analysis, namely: risk associated with particular positions, how much money should be invested in each position, the duration of keeping the positions, and things that involve metrics other than VAR. In addition, paired stocks must have some core features in common: industry sector, market capitalization, reported metrics, or corporate events.

Stay tuned with Sigma Global Management, and we will give you an overview of these points in our next post on asset management.