We would like to offer to your attention a more elaborated and profound article on portfolio hedging by our partner company in asset management Sigma Global Management: Enhancing The Efficiency of Hedging An Investment Portfolio With Sector-Based ETFs.

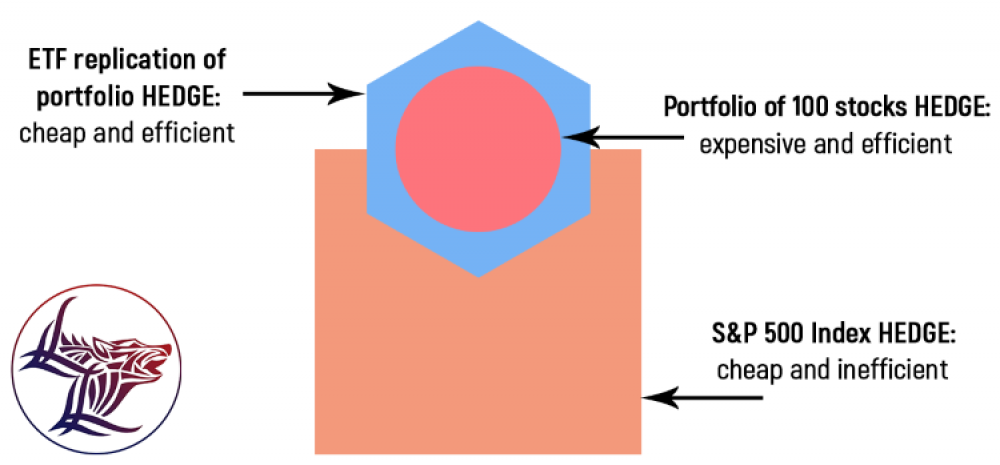

In this article, we examine how hedging the risk of a 100 stocks portfolio with sector-based ETFs is more efficient than hedging it with single stock options or S&P Index option/ETF.

Three steps performed in the examination are:

- Comparative analysis of three portfolios: a long-only, unhedged Portfolio 1, long Portfolio 2 hedged with SPY ETF Trust; and long Portfolio 3 hedged with 6 sector-based ETFs.

- Comparison of efficiency in hedging a securities portfolio with sector-based ETFs (Portfolio 3) versus an unhedged portfolio (Portfolio 1), and a portfolio hedged with SPY (Portfolio 2).

- Comparing beta, US market correlation, and alpha across the three portfolios.

To read the entire article, follow the link: https://www.advisorperspectives.com/commentaries/2022/02/22/enhancing-the-efficiency-of-hedging-an-investment-portfolio-with-sector-based-etfs?fbclid=IwAR2rhqgDKaBe8YAfwshw0kbObArmUyRg