A zero-coupon bond is a bond that does not pay coupons per period but instead trades at a discount from the face value. For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of $400. Although no coupons are paid, the investor will receive the face value upon maturity or upon selling the bond, provided the interest rates remain the same.

To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied:

[{F/PV}]^(1/t) =1+r

Where

F –face value of the bond

PV- current value of the bond

t –time to maturity

r- Interest rate

For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of $400. Although no coupons are paid, the investor will receive the face value upon maturity or upon selling the bond, provided the interest rates remain the same.

Zero-Coupon Bond Effective Yield Formula is different from bond yield equivalent formula. The zero-coupon bond effective yield formula shown above factors in the time value of money and compounded returns. Since the maturity period of zero-coupon bonds is typically quite some years, it is important to take into account the time value of money and the compounding effect when calculating the zero-coupon bond effective yield.

For example, an investment that pays 7% per year is not equivalent to a 10-year discount bond that pays a 100% return upon its maturity after ten years. The investment that pays 7% annually can be reinvested and, in this case, factoring in the compounded returns, the total return after 10 years would equal:

[(1+0.07)]^10=197%

By contrast, the formula for the bond equivalent yield does not factor in the compounding effect, which is why the formula for bond equivalent yield is mainly more suitable for comparing discount bonds of short maturity.

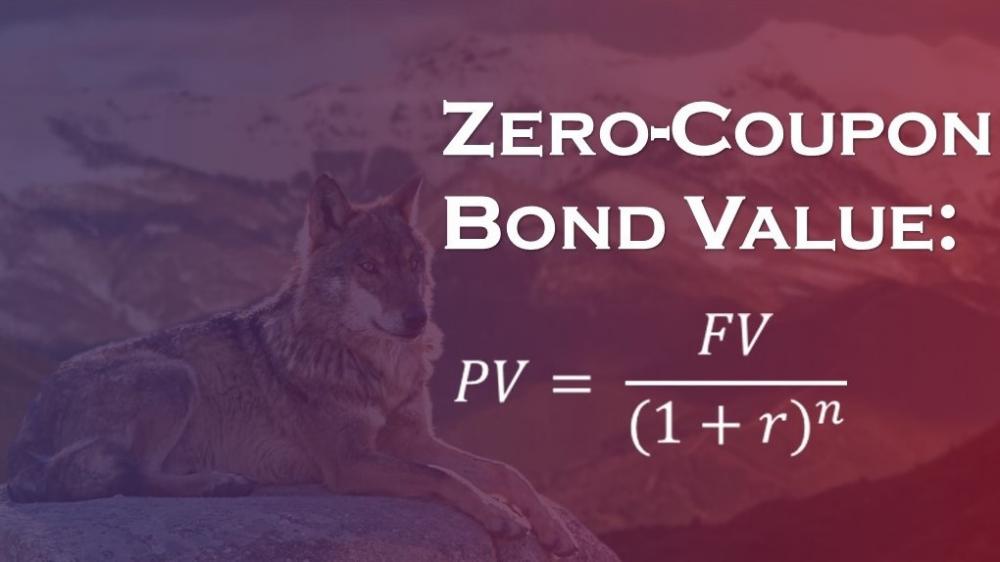

The formula for calculating the effective yield on a zero-coupon bond (discount bond), is derived by adjusting a zero-coupon bond formula for the present value:

Zero-coupon bond value (PV) = F/[(1+r)]^t

Which is further transformed as F/(PV )=[(1+r)]^t

Adjusting both sides of the equation further, we arrive at the initial formula we introduced in the beginning:

[(F│PV)]^(1⁄t) = 1+r

Plugging in the values from our example above where the face value of the zero-coupon bond Is $400, and discounted value is $200, t- 10 years, and r-7%, we receive:

[{400/200}]^(1/10) = 1+ 0.07

1.072 = 1+0.072

Subtracting 1 from both sides, we arrive at 7.2%.

Now, that we have covered the essentials of coupon vs. zero-coupon bonds and premium vs. discount bonds, it is the right time for us to move to the next bond type, - a perpetual bond.

Stay tuned with Wolfline Capital, and in our next post on capital markets, we will cover the subject of perpetual bonds. Should you have any questions, please do not hesitate to ask; - we will be happy to answer them.