The returns on bonds depend upon a number of factors: changes in issuers’ credit ratings, changes in prevailing interest rates, and changes in the yield curve. A bond strategy implies managing a bond portfolio with the purpose either to raise bond returns based on expected changes in factors influencing bond pricing or maintain a certain level of return irrespective of changes in those factors. Bond strategies can be active, passive, and hybrid.

The main objective of an active strategy is to generate greater returns. As follows from the name, active means the portfolio manager takes an active role in managing an investor’s portfolio. Active strategies typically include bond swaps, which means selling off one group of bonds to purchase another group to take advantage of expected changes in the bond market.

Before deciding on which bonds should be made a part of the investment portfolio, investment portfolio managers typically resort to a total return analysis that enables them to see how the bond portfolios with different durations would behave under different interest rate changes, based on the anticipated interest rate changes over the investment duration.

If interest rates are expected to decline, then buying bonds with longer maturities would be a feasible strategy, as they would yield the most return from an interest rate decrease. In anticipation of the rising rates, buying the bonds with shorter durations would be most beneficial, as they would minimize interest-rate risk.

For example, an investor may start buying bonds with longer durations expecting lower long-term interest rates; buying convertible bonds at the prospect of economic upturn; or maybe buying Treasury bonds in anticipation of the Federal Reserve quantitative easing policy intended to increase the money supply in the economy.

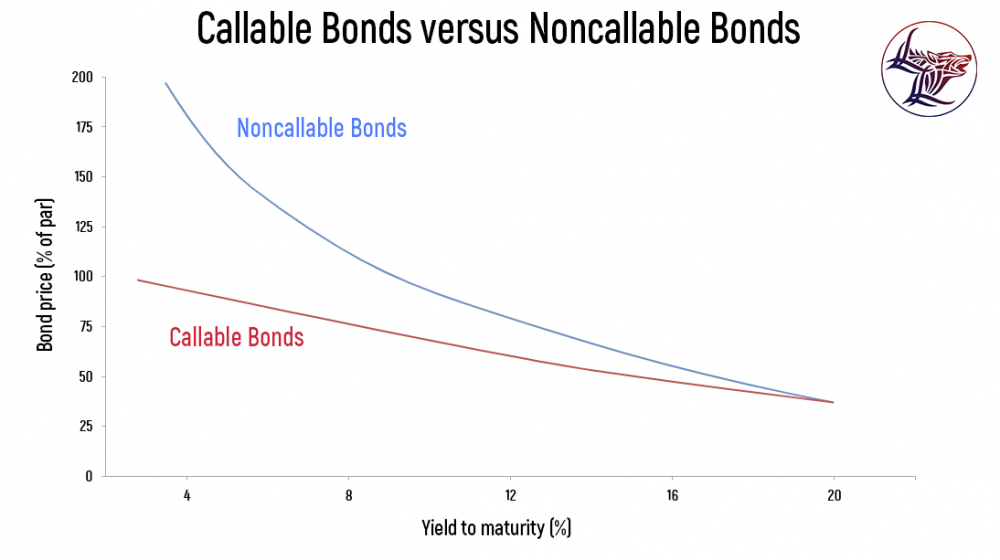

Some portfolio managers use buying cushion bonds as part of their active strategy. Cushion bonds are callable bonds typically sold with a premium with a coupon rate significantly exceeding the current market rate. The duration of cushion bonds is usually shorter than regular bonds because of their call feature. They are also generally cheaper than similar bonds without the call feature since they are redeemable before maturity. The relative resilience of the cushion bond to rate swings provides investors with some protection against interest rate changes.

Since the change in interest rates may not be parallel to the bond’s yield changes, the interest rate anticipation strategy should be based on a forecast of the yield curve.

Stay with Wolfline Capital, and you learn more insightful things about bond investment strategies, capital markets, and asset management.