This year has demonstrated an unparalleled turnaround in the global bond market with bond yields rising to historic proportions, creating a significant fret for fixed-income investors.

The 2-year US Treasury yield rose to more than 4.3% for the first time in more than 15 years; its nearly 3.5% yield increase over 2022 is also on par with the historical rise of 1994. Emerging Markets (EM) local bonds currently yield around 7% on average. This is around 400 basis points higher than the yield on the 10-year US Treasury. It is a level not seen in over a decade.

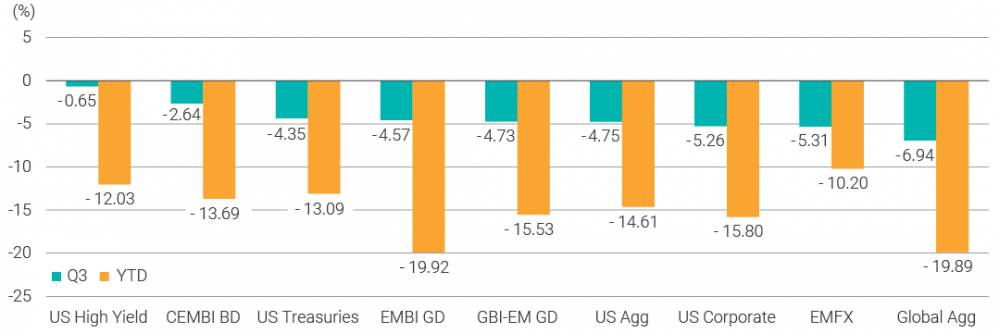

According to JP Morgan, in the six years leading to 2021, money poured into local and foreign currency EM bond funds at an average of more than $50bn a year. In the first nine months of the year, global bond funds faced a cumulative outflow of $175.5 billion, indicating a 10.2% average decline in their net asset values, which is the worst slump of this magnitude since at least 1990, according to Reuters data.

This year, at least 20 low- and middle-income countries have seen their foreign currency bond yields rise to a level more than 10 percentage points above those of comparable US Treasury bonds. Spreads at such high spreads often point to severe financial stress and default risk.

Although EM debt markets have suffered their worst drawdown ever, losing 25% of their value since the start of 2021, EM currencies have exhibited remarkable resilience compared with developed markets currencies such as the yen and euro. Thus far in 2022, EM currencies are down around 10% versus the dollar, while the basket of developed markets currencies such as the yen, euro, and pound is down around 18% against the US currency. Experts tend to attribute this relative strength to several factors, including aggressive and proactive central bank rate hikes in EMs, already cheap EM valuations, and light investor positioning as a result of significant fund outflows.

Milo Gunasinghe, the emerging markets strategist at JPMorgan, says he expects US and global financial conditions to tighten for the foreseeable future, keeping the bar high for inflows into EM bonds.